Our goal is to assist you in any way possible

Running a successful business means sweating the details. That's why we offer a wide range of services that can improve your money management, facilitate better cash flow, save time and enhance security.

Mastercard Debit/ATM Cards

Business debit cards come with a long list of convenient features. They can be used for quick purchases of supplies and inventory. They provide fast access to accounts through ATMs. And your business can order multiple cards and control expenses by authorizing specific spending limits for each card.

- 24/7 account access

- Accepted at any business that displays Mastercard logo

- Card designs to choose from

- Daily cash withdrawal limit of $400

- Daily spending limit of $1,000

- Accounted access protected by Personal Identifications Numbers (PINs) and other security measures

- Please notify one of our branches immediately if your Mastercard debit/ATM card is lost or stolen. After regular business hours, please call 1-866-546-8273.

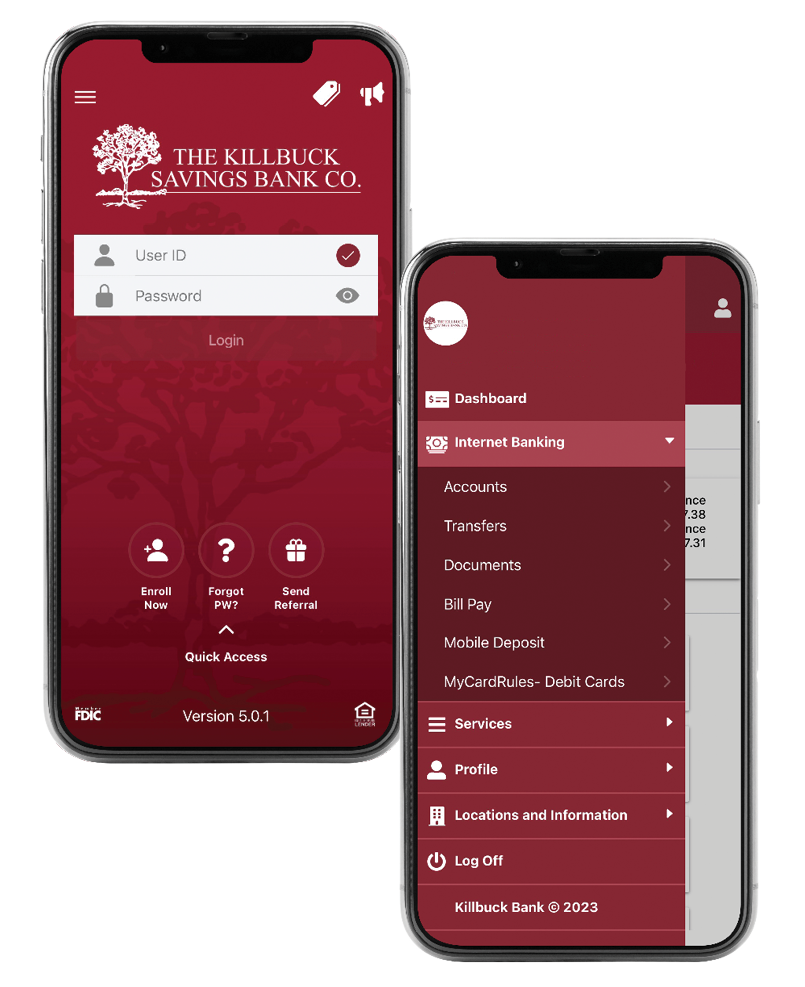

MyCardRules™ Debit Card Protection

With MyCardRules™, your finances are more protected than ever. Easy-to-use settings let you decide when, where and how your debit card is used. You can get a notification every time your card is used, turn your card on or off when necessary, limit purchase amounts, and much more.

- Enroll and manage MyCardRules™ from the KSB mobile banking app

- Protect yourself from fraud and unauthorized expenditures by instantly turning off a card that's been lost or stolen

- Deny transactions that exceed a spending limit that you've set

- Get a notification each time the card is used - or limit notifications to specific card activity

- Decline or restrict in-store transactions based on your settings

Merchant Services

Fewer consumers are paying for products and services with cash and checks and more are using debit and credit cards. Make sure your business can process these payments quickly and efficiently.

- With one account you can accept with a smart terminal, virtual terminal, mobile device, or website shopping cart

- EMV, NFC, contactless and QR code acceptance

- Online and mobile reporting dashboards

- Quarterly pricing audit

- Protection against rate increases and billing errors

- Instant and next day funding

- Surcharging, interchange optimization and high risk-processing available

- Customer service is available 24/7 from trained professionals

Card Connect (Merchant ID starts with 496 or 498) 1-877-828-0730

APS (Merchant ID starts with 5436 or 5200) 1-888-311-7248

Direct Deposit

Streamline your payroll process, save time and reduce your staff workload by transmitting funds directly to the bank accounts of your employees.

- Ask your human resources or payroll department to contact Killbuck Savings Bank for more information

- Make life easier for your employees by reducing trips to the bank and giving them faster access to their paychecks

- Security safeguards protect each employees' personal information and your business's account data

Bank by Mail

Some days, there's just no time for anyone from your business to make a trip to the bank. When that's the case, just drop your deposit, loan payment, certain utility payments, or any other banking document in a secure mailbox.

- Address your envelope to P. O. Box 407, Killbuck, OH 44637

- We do not recommend sending cash transactions through the mail

Night Depository

We know that it isn't always possible for you or one of your employees to get to the bank during regular business hours. Our locations feature safe, convenient facilities for after-hours cash and check deposits.

- Service is available at all branch locations except the Loan Annex

Safety Deposit Boxes

Certain items deserve more security than you can provide in your office or workplace. We offer safety deposit boxes of various sizes for reasonable annual fees.

- Safeguard important documents pertaining to your business, its insurance coverage and legal matters.

- Boxes available at these bank offices: Apple Valley, Berlin, Danville, Fredericksburg, Killbuck, Millersburg North, Millersburg South, Sugarcreek and Mt. Hope

Cashier's Checks

In commerce, cashier's checks are sometimes used for larger purchases or in transactions between companies without established financial relationships.

- Cashier's checks available for $7 fee

- Because they're signed by a bank official, they may be more widely accepted than your regular business checks

- Contain watermarks and other anti-counterfeiting measures

- Can usually be cleared by the receiving bank faster than your regular business checks

Foreign Currency Exchange

Headed out of the country on a business trip? There's one less thing to worry about when you arrive at your destination with the proper currency in hand.

- Receive a fair exchange rate

- Use cash to avoid card-related international service fees on smaller purchases

- Receive assistance with any questions about your destination's accepted currency

- Cash in your international currency after returning from abroad

- Foreign currency orders greater than $300 will incur a $13.00 fee

- Foreign currency orders $300.00 or less will incur a $23.00 fee